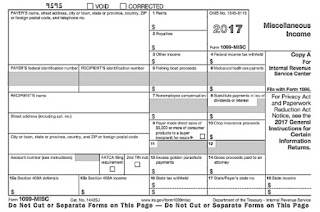

Perhaps one of the most confusing parts of filing taxes is

all of the “tax jargon” that is used.

When you don’t know what any of those terms mean, it’s easy

to end up feeling confused and frustrated. Fortunately, though, it is also fairly easy to educate

yourself on some of the more commonly used (and commonly misunderstood) tax

terms.

Adjusted Gross Income

One term that you’ll definitely hear come tax-time is

“adjusted gross income.” This term refers to the modified version of your total

income that you receive from all different sources. However, you can, in many cases, subtract some deductions

from your adjusted gross income. The amount that you ultimately come up with will determine

your tax bracket, which is why it’s important to take advantage of all of the

deductions you possibly can- something a good tax professional can assist you

with.

Tax Credits

You may also hear a lot about “tax credits” during tax

season. These are another great way in which you can lower your

taxes. They are similar to deductions but, instead of being

subtracted from your income, they are basically applied to the funds you owe. Some of the credits for which you may be eligible are even

refundable, which means that if they equal more than you owe in taxes, you can

get a nice refund. You can learn about different credits and find the ones you

are eligible for by working with a tax professional.

Withholding

Finally, you might hear a bit about “withholding.” This is how you pay your taxes to the IRS while earning

money. Your employer can set up withholding so that it happens

without you having to worry about it. If that doesn’t happen, however, you

could have to pay a penalty when you file. On the other hand, if you over-withhold, you can enjoy a tax

refund. However, that is not always advisable, which is why it’s good to work

with someone who knows and understands taxes inside and out.

In fact, while it is certainly smart to educate yourself on

tax terms, remember that nothing beats the help of a true professional.