These days, it seems like everyone is in need of a little

extra money. And, more and more people are turning to online selling sites,

such as Ebay and Etsy, to earn that money.

Getting those nice

checks or Paypal funds from selling merchandise or handmade goods is certainly

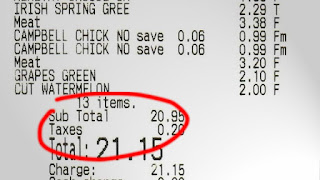

great, but remember, that money is subject to taxation too. If you forget that,

you could face problems down the road. You could also face problems if you don’t

figure your taxes correctly, which is why you need to know a few important

things before you start (or continue) selling online.

To start off with, understand that if you are earning money,

you absolutely have to report that money as business income. Not doing so could

mean facing fines and penalties, so don’t take the chance.

Furthermore, you have to collect sales tax on your sales and

also report any foreign sales that you have made.

Depending on the selling platform that you have chosen to

use, you may have some help with these taxation matters. Amazon, for example,

does require its sellers to complete an income tax identification form. Other

sites, though, don’t report to the IRS and don’t keep track of your earnings,

which means it’s up to you to handle your taxes legally and correctly.

The first step in doing this is typically to contact your

state tax department to get set up to collect sales tax. Once you’ve done that,

you need to keep careful records on each of your sales and your overall income.

If all of this sounds tricky and like a lot to keep up with,

it’s because it is! However, doing everything “on the up and up” is definitely

worth it since it will keep you from encountering troubling tax problems in the

future. And, the good news is that you don’t have to figure all of this stuff

out on your own. A qualified accountant can easily handle your tax issues for

you or at least provide you with advice and guidance to help you do it on your

own.

Thus, if you are planning to start selling online or to keep

selling online but to do it legally, an accountant should be the very first

person you contact.

No comments:

Post a Comment

I welcome your comments here :)