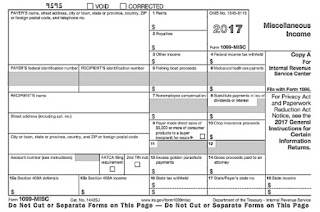

Often times, people will get 1099-MISC forms in the mail…and

then feel unsure about what those forms mean or what they’re supposed to do

with them. If this happens to you, don’t worry. Appropriately handling your

1099-MISC form is not difficult.

When you get one of these forms, the first thing that you

should know is that you’ll need to report the related income on your tax

return. You will also be required to pay income tax and self-employment tax on

these funds.

And, if you’re wondering why you’re getting one of these

forms in the first place, it’s simply because you did work for someone as an

independent contractor. Since you’re not a full-time employee of this person or

organization, you get a different form than the standard W-2 that regular

employees get.

1099-MISC Forms for

Businesses

If you own a business and are receiving the form as a

business owner, how you will need to report the income is a bit different and

will vary depending on the type of business you own. For sole proprietors or single-member LLCs, you can report

the income on Schedule C- Profit or Loss from Business.

Partnerships, multiple-member LLCs, and corporations, on the

other hand, will include 1099 income as part of their business income tax

returns.

If your situation or business doesn’t fit neatly into one of

the above categories, then it may be smart to speak with an experienced

accountant about your situation.

No comments:

Post a Comment

I welcome your comments here :)