When it comes to filling out tax forms, you are typically asked a lot of questions that require a numerical answer. One of the most difficult of these questions to figure out is your “adjusted gross income,” and this is a figure that is asked for on just about every tax return you will fill out. However, this number can vary depending on the form that you are using since some forms allow for more income adjustments than others.

Total Income

One good rule of thumb to keep in mind is that your adjusted gross income will never be higher than the total income that you report.

This is because your total income is made up of all of your annual earnings that are taxable.

Deductions

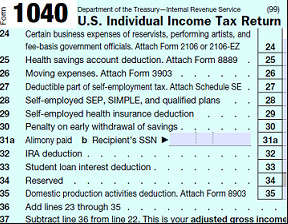

As you fill out your tax form, you will find that there are some areas in which you can qualify for deductions, and some of these deductions will actually lower your total income, which will, in turn, affected your adjusted gross income.

The deductions that are factored into your adjusted gross income are “adjustments to income” or “above the line” deductions.

You can learn about qualifying deductions by talking with a tax professional. These professionals can also help to ensure that you don’t miss a single deduction that you could possibly take.

The Impact of Your Adjusted Gross Income

Your adjusted gross income will have an impact on other deductions and credits that you can claim. For this reason, you want to take steps to legally reduce your adjusted gross income as much as possible because the lower it tends to be, the better that is for you, tax-wise.

Of course, you still have to report your adjusted gross income correctly and honestly, but, with the help of the right tax professionals, you can lower this amount to receive significant benefits.

No comments:

Post a Comment

I welcome your comments here :)