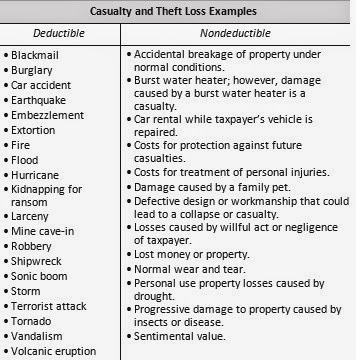

Casualty Loss

A casualty loss is the damage, destruction, or loss of

property resulting from an identifiable event. The identifiable event must be:

• Sudden,

not gradual or progressive.

• Unexpected,

not ordinarily anticipated or intended.

• Unusual,

not a day-to-day occurrence or typical of the taxpayer’s activity.

Theft Loss

A theft is the taking and removing of money or property

with the intent to deprive the owner of it. The taking of property must be:

• Illegal

under the law of the state where it occurred.

• Done

with criminal intent.

Deductible Amount of Losses

A non business casualty or theft loss is the lesser of the

taxpayer’s basis in the property damaged or destroyed, or the reduction in fair

market value due to the casualty or theft. From this amount, any insurance or

other reimbursement received, or that could have been received, if the taxpayer

chose not to file a claim is subtracted.

The casualty or theft loss is then reduced by $100 per

event when computing the deductible amount. Multiple items lost in a single

event result in only one $100 reduction. The total of all casualty and theft

losses from all events during the year is further reduced by 10% of the

taxpayer’s adjusted gross income.

Criminal Fraud

Victims of criminal fraud or embezzlement related to a

transaction entered into for profit are allowed to deduct the theft loss as a

miscellaneous itemized deduction not subject to the 2% adjusted gross income

limitation. The deduction is also not subject to any other theft loss or

itemized deduction reductions or limitations.

Insurance

Losses are not deductible to the extent they are reimbursed

by insurance. If property is covered by insurance, a timely insurance claim for

reimbursement must be filed or the deduction is not allowed. The part of the

loss not covered by insurance is deductible. If a casualty loss is claimed in

one year, and in a later year the taxpayer receives reimbursement for the loss,

the deductible loss is not recomputed for the taxable year in which the

deduction was taken. Rather, the reimbursement amount is included in income in

the taxable year in which it was received.

Insurance proceeds used for living expenses are not

reimbursements for damages so amounts paid for normal living expenses are

generally taxable. However, payments to cover a temporary increase in living

expenses are excluded from income.

Note: If the

casualty occurs in a federally declared disaster area, none of the insurance

payments are taxable.

Gain on Reimbursement

If insurance or other reimbursement is more than the basis

in the property damaged or destroyed, the reimbursement is a gain. The gain is

taxable if a taxpayer does not use the proceeds to purchase replacement

property similar or related in service and use. The gain is postponed if:

• The

taxpayer purchases property that is similar or related to it in service or use

within two years of the end of the first tax year in which any part of the gain

is realized (or acquires at least 80% of a corporation owning such property),

and

• The

cost of the replacement property is equal to or more than the reimbursement

received for the damaged, destroyed, or stolen property.

If the replacement property costs less than the

reimbursement, gain is recognized to the extent the reimbursement exceeds the

cost of the replacement property.

Federally-Declared Disaster Areas

A federally-declared disaster is a disaster determined by

the President to warrant federal government assistance. The 10% of adjusted

gross income limitation for casualty losses also applies to the portion of loss

due to a net disaster loss.

Year of Deduction for a

Federally-Declared Disaster Loss A taxpayer may elect to deduct a loss

in a federally-declared disaster area in the tax year immediately prior to the

disaster year. The return (or amended return) claiming the loss must be filed

by the later of: The due date for filing the original return (without

extensions) for the tax year in which the disaster occurred, or The due date

for filing the original return (including extensions) for the tax year

immediately prior to the tax year in which the disaster occurred. Items to

include on the tax return include the date of the disaster and the city, town,

county, and state in which the damaged or destroyed property was located.

Disaster Relief

Food, medical supplies, and other forms of assistance

received do not reduce the casualty loss, unless they are replacements for lost

or destroyed property. Qualified disaster relief payments received for expenses

incurred as a result of a federally declared disaster are not taxable income.

Cash Gifts for Disaster Victims

If a taxpayer receives a cash gift as a disaster victim

(such as gifts from relatives and neighbors) and there are no limits on how the

taxpayer can use the money, the gift is excluded from income. The casualty loss

is not reduced by the cash gift. This is true even if the cash gift is used to

help pay for repairs to property damaged in the disaster.

When to Deduct a Casualty or Theft Loss

Casualty or theft losses are deductible in the year the

casualty occurred or the theft was discovered. If it is uncertain whether

insurance will reimburse all or a portion of the loss, do not deduct the

amounts of the loss in question until the tax year when it is reasonably certain

the loss will not be reimbursed.