In a recent study, 40% of consumers responded that they don’t have enough life insurance to meet their families’ long-term needs.1 This concern raises an obvious question: How much life insurance is enough? What might be appropriate for a family with two young children and a stay-at-home spouse could be significantly different from the needs of a working couple whose children are grown.

Do the Math

Rather than using the oft-recommended formula of replacing eight to ten times your annual income, a better tactic might be to calculate the life insurance benefit amount that could provide the income to meet your family’s long-term needs and goals.

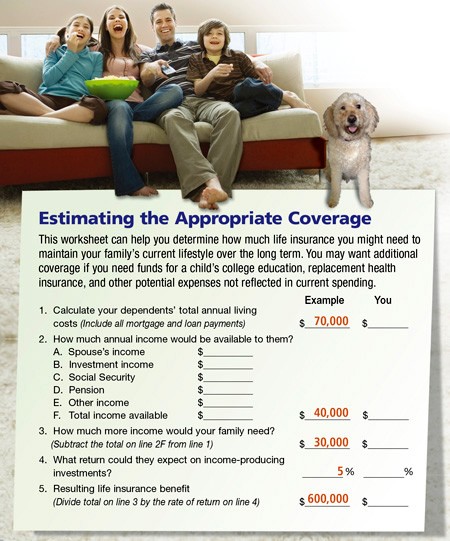

In the hypothetical example below, the family’s living expenses were $70,000 and the surviving spouse would have access to $40,000 of income, leaving $30,000 of annual income to replace. The next step is to determine the life insurance death benefit that could replace this annual income.

In order to do this, you estimate an average annual rate of return that might be achieved if the death benefit amount were invested in income-producing financial vehicles, without reducing the principal. For this example, a 5% rate of return is used. Of course, this rate of return is not representative of any specific investment; actual circumstances and results will vary.

In order to do this, you estimate an average annual rate of return that might be achieved if the death benefit amount were invested in income-producing financial vehicles, without reducing the principal. For this example, a 5% rate of return is used. Of course, this rate of return is not representative of any specific investment; actual circumstances and results will vary.

Dividing $30,000 by 5% (.05) equals $600,000. A $600,000 life insurance benefit earning a 5% average annual rate of return could yield a $30,000 annual income.

Although this worksheet is a good starting point, for a more accurate result you should include all the potential expenses that might enable your family to live the way you want them to live. For example, you could include funds for your child’s college education. If health insurance is paid for by your employer, your family may need replacement coverage. And don’t forget final expenses such as funeral and burial costs.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. If a policy is surrendered prematurely, there may be surrender charges and income tax implications.

Life insurance could be a key step toward providing security for your loved ones. It’s important to review your coverage regularly to make sure you have sufficient protection for your family’s situation.

1) financial-planning.com, September 26, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek Naperville Accounting and Naperville Insurance advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.

On June 28, 2012 — two years and two months after passage of the

On June 28, 2012 — two years and two months after passage of the

Lawsuits have become increasingly common in our society. From 1951 through 2009, the cost of torts (civil suits) rose at more than double the annual rate of general inflation and even surpassed the annual increase in medical expenses (see chart).

Lawsuits have become increasingly common in our society. From 1951 through 2009, the cost of torts (civil suits) rose at more than double the annual rate of general inflation and even surpassed the annual increase in medical expenses (see chart). Typically, you can obtain $1 million in coverage for a few hundred dollars a year. However, you must usually purchase the maximum liability coverage on your homeowners and automobile policies; they serve as a deductible for the

Typically, you can obtain $1 million in coverage for a few hundred dollars a year. However, you must usually purchase the maximum liability coverage on your homeowners and automobile policies; they serve as a deductible for the

When crafting your disaster plan, schedule annual insurance reviews to make sure your coverage is keeping up with company changes. Updating your policy is especially important if you have expanded or purchased new equipment.

When crafting your disaster plan, schedule annual insurance reviews to make sure your coverage is keeping up with company changes. Updating your policy is especially important if you have expanded or purchased new equipment.