Nobel prize-winning economist Milton Friedman once said that “Inflation is taxation without legislation.”1 You’re probably aware of how taxes reduce your earnings, but have you thought about the effect of inflation?

Over the last 50 years, U.S. inflation (as measured by changes in the consumer price index or CPI) has averaged a little more than 4% a year.2 A hypothetical investment earning a 5% average annual return during this period would have returned only about 1% after inflation. The rate of return would have been further reduced by income taxes.3

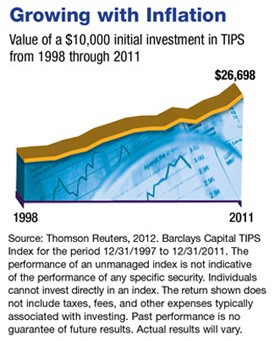

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.

The principal value of TIPS fluctuates with market conditions. As the principal amount grows, so do the interest payments, which means that the income generated has the potential to increase over time. However, unless you own TIPS in a tax-deferred account, you have to pay federal income tax on the income plus any increase in principal, even though you won’t receive the accrued principal until the bond matures.

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. If not held to maturity, they may be worth more or less than their original value.

1) brainyquote.com, 2012

2, 4) Thomson Reuters, 2012 (CPI for the period 12/31/1961 to 12/31/2011)

3) This hypothetical example is used for illustrative purposes and does not represent the performance of any specific investment. Actual results will vary.

2, 4) Thomson Reuters, 2012 (CPI for the period 12/31/1961 to 12/31/2011)

3) This hypothetical example is used for illustrative purposes and does not represent the performance of any specific investment. Actual results will vary.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent Naperville Accounting Firm or advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.

No comments:

Post a Comment

I welcome your comments here :)