If you’ve been paying attention to financial news lately,

you’ve probably heard that the Senate Republications have proposed a

controversial new legislation. Frustrated with the IRS and with the fact that

reducing its funding doesn’t seem to be getting the desired results, these

people are asking to outsource its tax debt collections, one of the IRS’ main

sources of survival and primary functions.

The legislation request is included as part of a law to help

extend the Highway Trust Fund, and the GOP is requesting that Senate leaders

foot the bill for the extension by outsourcing some of the IRS’ collection

duties to private collection agencies. The Senate Republicans believe that

outsourcing can lead to over $2 billion in savings in a decade.

As is to be expected, not everyone is on board with this

idea. The National Treasury Employees Union, for example, believes that

outsourcing to private collection agencies would waste taxpayer’s money. Likewise, the Center for Effective Government

has been adamant about its belief that it is the government’s job, and the

government’s job alone, to collect taxes.

Those who do argue in favor of the new legislation are quick

to point out that the IRS has not been very effective at collections. Others

are looking for specific people or offices on which to cast blame, with many

pointing to IRS managers and Congress itself. Many Democrats believe that the

only problem the IRS has is poor funding, and that it needs more funding in order

to better pursue collections.

Even those who are not politically affiliated tend to agree

with the Democrats, saying that the IRS would do just fine at collections if it

had more money and that outsourcing is not necessary. Because the vast majority

of people see the potential flaws and threats of outsourcing IRS tax collection

efforts, it’s not looking very likely that this will happen…but only time will

tell.

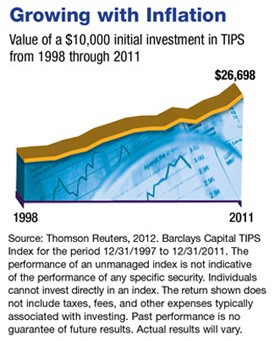

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.