Tax-time is a stressful time, especially if you haven’t

prepared for it properly!

The best way to reduce the stress is to have a plan in

place! Each year, after you file your taxes, take a look at what you were

pleased with and what you wish was different. Then, you can come up with a plan

to help improve the following years’s tax returns.

Below, we’ve offered up some simple strategies that can help

you to have a better time on your taxes next year, but if you need more

specific advice, a qualified CPA is always the best person to

turn to.

Tip #1: Think Long-Term

When you file taxes, it’s tempting to just go with whatever

is going to get you the most money the soonest. However, you really need to

consider how your tax decisions today are going to affect you in the future; in

other words, think long-term!

For example, when it comes to passive index investing,

people often put off selling their best portfolio pieces because they don’t

want to pay the capital gains. More often than not, though, capital gains

aside, selling would still be the wisest and most profitable decision over

time. And that phrase- “over time”- is key; no matter what kind of decision

you’re trying to make, choose the option that is going to pay off for the

longest amount of time, even if it costs you money upfront or gives you a

smaller-than-you’d-like amount upfront.

Tip #2: Change Custodians (if necessary)

If your current custodian isn’t working for you, or, if

another custodian is offering you better service and a nice bonus to change

custodians, then by all means, do it! These days, you can typically switch

everything over online, meaning no hurt feelings. Plus, no capital gains taxes

are involved, so it’s really a win-win, providing you research your new

custodian carefully and make sure it’s a good, long-term choice.

Tip #3: Get Help from a Pro

Finally, recognize that no matter how much you know about

taxes and tax law, a professional is going to know more.

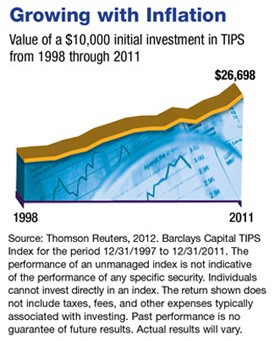

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.

Inflation, which was near zero in 2008 during the depths of the recession, reached almost 3% in 2011.4 If you want to help protect your investment dollars from future inflation, you might consider Treasury Inflation-Protected Securities (TIPS). Not only do TIPS have similar earnings potential to other Treasury bonds, but they are adjusted for inflation. If the CPI rises, the principal value of TIPS increases. If the CPI falls, the principal value falls. TIPS pay interest twice a year, and the investor receives either the original or the inflation-adjusted principal (whichever is greater) when they mature.