It’s no secret that property taxes can get pretty high, and,

while you can’t escape paying them altogether, there definitely are things that

you can do to cut down on your property taxes. In fact, there are quite a few

credits, deductions, and exemptions that you may qualify for. We’ll cover a few

of the basics here, but remember, you should always be able to go to your

accountant and/or tax adviser to learn more about available discounts and how

to take advantage of them.

Veteran Assistance

First things first, are you a veteran? If so, then there are

probably several different property tax related credits, deductions, and/or

exemptions that you can qualify for. However, these do vary from state to

state, so, where you live will play a big role in which of these you can

receive. Ask your tax adviser to point you in the right direction!

Aid for Senior Citizens

Veterans aren’t the only ones who can get a break on their

taxes! Senior citizens are another group that is often eligible for discounts,

especially in the case of senior citizens who are over 65 and fall into a lower

income bracket. Again, these discounts do vary from one state to the next, so

check with your tax adviser. It’s definitely worth the effort because some

discounts are so good they can keep you out of foreclosure.

A Hand for Farmers

Finally, even farmers can get a little

credit...literally. Land that is deemed “agriculturally productive” qualifies

for property tax breaks in most states, especially Florida, which is very

liberal when it comes to handing out this credit. Other states, however, have

more stringent requirements, but, no matter where you live, this credit and all

the others are worth looking into. In fact, you should really ask your tax

adviser to help you uncover and make the most of every possible discount you

may be eligible for!

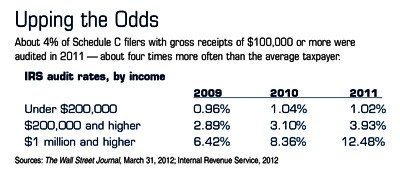

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit.

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit. To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria:

To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria: