Artificial intelligence (AI) is an important concept in

today’s world. Through AI, many jobs have been eliminated or at least made more

streamlined. And, now, many speculate that accounting will be the next industry

to find itself impacted by AI.

Part of the reason for this speculation is the fact that a

German software firm recently acquired $3.5 million in financing for an AI

program known as Smacc, which is designed to help businesses automate their

accounting.

The software has a lot of features that are getting people

excited, such as its ability to review receipts, its math-checking features,

and its ability to “learn” and apply what it has learned to future projects and

tasks.

Another nice feature of this program is that information can

be checked into at any time, allowing businesses to really stay on top of their

financial situations.

Of course, despite all of these benefits, AI programs like

this one definitely aren’t perfect. And, since such programs are relatively

new, it makes sense that it would take some time to work out the “bugs.”

For this reason, businesses and individuals are cautioned

not to give up on traditional accountants just yet. In fact, even for those who

do decide to give Smacc a try, it’s worthwhile to have an accountant who can

check up on the program and make sure all tax matters are being handled

correctly.

While it seems some people are ready to take the plunge into

the world of AI, it’s smart to tread cautiously and to not give up on real

human help just yet.

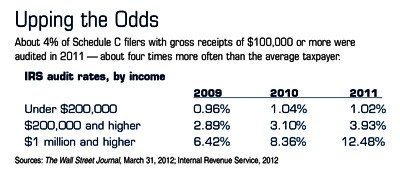

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit.

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit. To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria:

To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria: