Business owners have the choice of hiring either a

bookkeeper or a CPA to handle their business’s financial records and keep track

of sales transactions. However, if they’re being honest, most business owners

really don’t know or fully understand the difference between the two.

It’s easy to see why they would have this problem since the

distinction between the two professions is becoming less and less clear,

especially with all of the combination bookkeeping and accounting software

available today. However, there is still a difference between a bookkeeper and

a CPA, and every business definitely needs one or the other. For that reason,

it is imperative that business owners educate themselves on the two options and

on which one is the best fit for their business.

Bookkeepers

Bookkeepers are responsible for keeping track of all of the

daily transactions that go on within a business. Some of their responsibilities

include:

l Recording

sales

l Recording

purchases

l Keeping

track of receipts

l Noting

payments from customers

l Noting

payments to vendors

l Posting

credits/debits

l Generating

invoicing

l Balancing

ledgers

l Reconciling

bank accounts

l Preparing

financial statements

Because they have so many major responsibilities, most

bookkeepers have at least a two year degree in the field and work exclusively

for one business. They tend to be a part of the workplace just like any other

employee.

Accountants

Accountants or CPAs, on the other hand, are not quite as “hands

on” or visible in the workplace. Most CPAs have several business clients that

they work for, and more often than not, they will work from their own, separate

business location.

Like bookkeepers, they deal in the finances of the

businesses that they work for, but they are less concerned with day-to-day

tasks and recordings than they are with looking at how a business is doing

financially over all and on what choices would be wise for a business to make

to maintain good financial footing.

Like bookkeepers, they deal in the finances of the

businesses that they work for, but they are less concerned with day-to-day

tasks and recordings than they are with looking at how a business is doing

financially over all and on what choices would be wise for a business to make

to maintain good financial footing.

Some of the tasks of a CPA include:

l Analyzing

budget and operational costs and suggesting improvements

l Preparing

financial reporting statements

l Performing

audits and assessing their findings

l Making

informed predictions about a business’s financial future, as well as suggestions

for improvement and better performance

l Completing

tax returns

Which One Should You Choose?

Now that you understand a little bit more about accountants

and CPAs, hopefully you’ll have a better idea of which one might be the right

fit for your business.

If you’re still on the fence, then you should consider what

exactly you’re looking for, as well as the size of your business. Smaller

businesses can often handle bookkeeping tasks on their own, especially with the

right software, and really only need an accountant. Larger businesses may need

the help of both.

In general, if you can only choose one or the other, an

accountant is the way to go since this person will basically serve as a

financial adviser on your most important business decisions, but the choice is

yours to make, so put some thought into it before hiring a CPA, a bookkeeper,

or both.

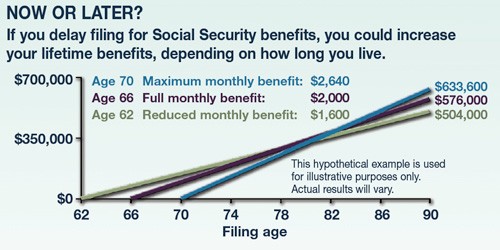

If you are married, Social Security allows additional filing strategies that you and your spouse may want to consider. Here are two hypothetical examples shown for illustrative purposes only; individual results may vary. Both examples assume that the husband and wife have reached age 66 and are eligible for full retirement benefits.

If you are married, Social Security allows additional filing strategies that you and your spouse may want to consider. Here are two hypothetical examples shown for illustrative purposes only; individual results may vary. Both examples assume that the husband and wife have reached age 66 and are eligible for full retirement benefits. Example 2. John and Mary are eligible for benefits of $2,000 and $1,600, respectively. If they both claim full benefits at age 66, they could receive a total of $1,036,800 over the next 24 years. Alternatively, Mary could claim her benefit and John could claim a spousal benefit of $800 (one-half of Mary’s $1,600 benefit amount); then at age 70 John could switch to his own maximum benefit of $2,640 based on his own work record. This strategy would yield the couple a total of $1,132,800 over 24 years, an additional $96,000.4

Example 2. John and Mary are eligible for benefits of $2,000 and $1,600, respectively. If they both claim full benefits at age 66, they could receive a total of $1,036,800 over the next 24 years. Alternatively, Mary could claim her benefit and John could claim a spousal benefit of $800 (one-half of Mary’s $1,600 benefit amount); then at age 70 John could switch to his own maximum benefit of $2,640 based on his own work record. This strategy would yield the couple a total of $1,132,800 over 24 years, an additional $96,000.4

Wouldn’t it be disappointing to dream about a comfortable retirement and then find yourself unable to enjoy your leisure years because of limited financial resources? Unfortunately, this is a possibility for people who underestimate retirement expenses and the rising cost of living.

Wouldn’t it be disappointing to dream about a comfortable retirement and then find yourself unable to enjoy your leisure years because of limited financial resources? Unfortunately, this is a possibility for people who underestimate retirement expenses and the rising cost of living. Enjoy the Lifestyle You Want

Enjoy the Lifestyle You Want